Diabetes is a chronic (long-lasting) disease that affects the way your body turns food into energy. There are three main types of diabetes: type 1, type 2 and gestational diabetes (diabetes that occurs when you’re pregnant). Around 90% to 95% of those who have been diagnosed with diabetes have type 2 diabetes.

Diabetes is the seventh leading cause of death in the U.S. But the good news is that it can be managed. The first step is to determine whether you have it or are at risk of developing it. More than 37 million Americans have diabetes, and 1 in 5 Americans don’t know it. 96 million U.S. adults have prediabetes, and 8 in 10 don’t know they have it. Concerned that you might be at risk? Take a moment to watch this informative seven-minute video from Omada.

Hello, and welcome to this presentation Understanding Prediabetes and Diabetes. My name is Kristen, and I’m an Omada Health coach team lead. I have a background in nutrition, health care, and also diabetes care and management and live in Ohio with my family.

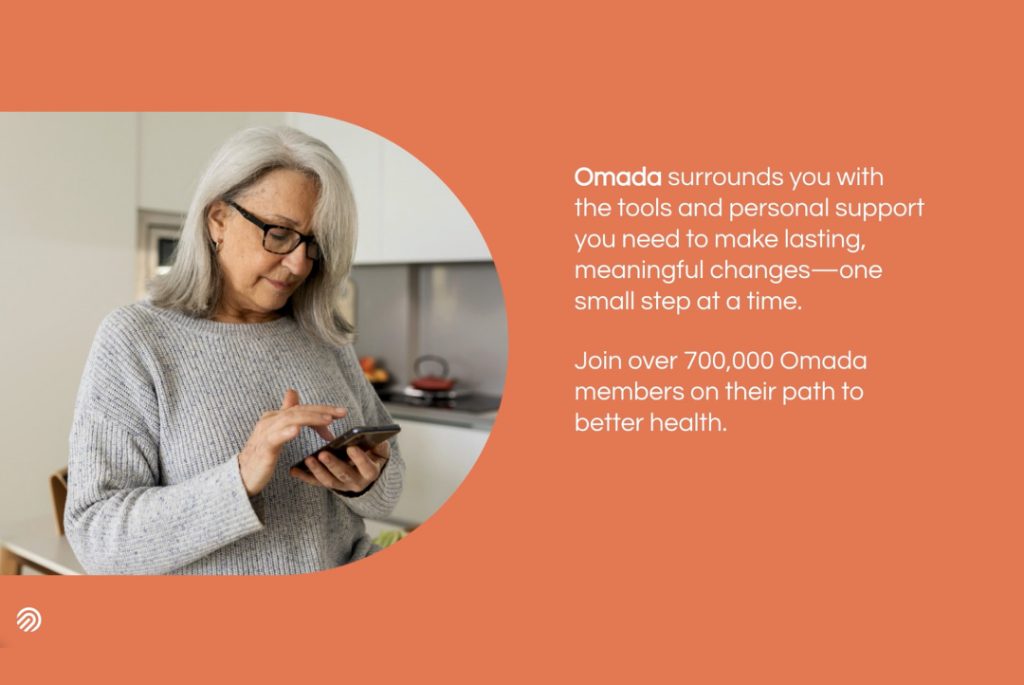

In my role as a health coach for Omada Health, I have the privilege of providing employees like you with dedicated, one-on-one coaching to help them achieve their health goals. Before we begin, let me take a moment to introduce Omada Health, one of the sponsors of this presentation. Omada was founded in 2011 to inspire and engage people in lifelong health.

Omada delivers virtual first programs that help people manage chronic conditions, including prediabetes and diabetes, through engaging digital tools and one-on-one personalized coaching. Today, Omada serves more than 700,000 members across the U.S. in their goal to manage their condition and improve their health.

In today’s presentation, I’ll help you build your knowledge about prediabetes and diabetes. If you’re currently living with one of these conditions, I’ll also show you how you can take advantage of your Omada benefit that can help you feel better physically and mentally.

You may be one out of every three people who has prediabetes. Or you may be one of the four in five people with prediabetes – that’s 80% – who doesn’t know they have it.

Or maybe you’re one out of every 10 people who lives with diabetes. Guess what? One in five don’t know they have diabetes, and every 17 seconds someone is diagnosed with diabetes.

And then there’s Covid-19. Research has shown that being overweight and having underlying health problems can increase the seriousness of Covid-19. More recent research is finding that if you’ve had Covid-19, you are at increased risk of developing diabetes just one year later.

But there’s good news. Prediabetes and diabetes are both preventable and even manageable with education and the right tools and support.

What is prediabetes? Prediabetes means you have higher than normal blood sugar, or blood glucose level. For most people, without lifestyle changes, prediabetes can develop into type 2 diabetes. And having these high levels of blood sugar is harmful for your body.

Here’s why blood glucose matters. Any carbohydrate you eat is broken down by your body into glucose. Glucose is the fuel that gives your body energy. Your bloodstream carries the glucose to your cells, providing nutrients to keep your body going.

There’s just one catch. Your cells can’t absorb glucose without insulin. Insulin is a hormone produced in your pancreas. When your food is converted to glucose, your pancreas dumps the right amount of insulin into your bloodstream so your cells can absorb it.

If you have prediabetes and it worsens, your pancreas may not produce enough insulin. This means more glucose is staying in the bloodstream and not fueling the cells. This is one of the reasons glucose levels will spike after eating and remain higher than normal long after you finish your meal. It’s also why cells start to starve. Over time, the condition becomes diabetes. If not properly managed, diabetes can cause serious damage to your body.

The two most common forms of diabetes are either type 2 or type 1 diabetes. Type 2 is the most common as nearly 95% of all people with diabetes has type 2. But it is largely preventable and can be managed through lifestyle changes, medications and insulin. Type 1 diabetes is an auto-immune condition, and no one knows how to prevent it. In many cases, the body stopped producing insulin, so it requires taking insulin in order to manage it.

What damage can diabetes do? In two words: a lot. Diabetes can lead to damaged blood vessels in the eyes, heart, kidneys and feet. It’s the number one cause of adult blindness, kidney failure, lower limb amputations and it’s tied to heart disease, the leading cause of death in the U.S. The entire body is impacted.

Many factors can increase the risk of prediabetes and diabetes. Let’s start with the things you can control. Being overweight and sedentary. The more fatty tissue you have on your body, the more resistant your cells become to insulin. If your blood pressure and cholesterol are at abnormal levels, the more prone you are to diabetes. Even sleep problems can increase the risk of insulin resistance and prediabetes. There are also factors out of your control. Race: If you’re African American or American Indian, you are more likely to develop diabetes. Family history: Your risk increases if a parent or sibling has been diagnosed with type 2 diabetes. And age: your risk increases with age, especially over the age of 45. As you see simple changes to your lifestyle can help prevent prediabetes and diabetes.

Navigating a chronic condition is touch. Having support along the way can make all the difference. Thankfully, through your health benefits, you get access to Omada, a leading virtual care provider that surrounds you with the personal support you need to manage your condition and make lasting, meaningful changes in between doctor visits, one small step at a time. Join over 700,000 Omada members on their path to better health.

Omada for Prevention is a virtual program that makes it easier to lose weight and reduce your risk of developing diabetes. If eligible, you get a program valued up to $700 at no cost to you that includes a personalized health coach, a personalized care plan, weekly lessons, tools for managing stress, and online peer group and communities. Plus, you get a smart scale to track your progress. It’s yours to keep.

If you’ve been diagnosed with diabetes, Omada for Diabetes is a virtual program that makes it easier to control your glucose levels, improve your health, and live life with more confidence and less stress.

If eligible, you get a program valued up to $1,700 — at no cost to you — that includes a personalized health coach, a certified diabetes specialist, a personalized care plan, weekly lessons, tools for managing stress, plus smart devices to easily monitor your blood glucose and track your progress. You keep them all.

Just visit the website on your screen to learn more about Omada and apply. And thank you all for your time today.

For more information on how you can use your Costco benefits to support your physical well-being, check out the resources below.