TAKE ACTION

OCTOBER 2022

Choose in-network dental care and save

You’ve probably heard that one of the best ways to save on health care costs is to “stay in network.” But what exactly does that mean? Do you really save money on dental care? What if you need treatment when you’re away from home? Whether your dental plan lets you go out of network or requires you to see an in-network dentist, there are reasons why you should you should always choose an in-network dentist.

Looking for more? Find other articles below

What does “in-network” mean?

A network is a group of health care providers. It includes dentists, doctors, specialists, hospitals, surgical centers and other facilities. For mainland Costco employees who participate in Costco’s medical and dental plans, these health care providers have a contract with Aetna®. (In Hawaii, it’s HMSA. Puerto Rico’s Triple-S plan does not contract with dental providers.)

As part of their contract, they provide services to our employees and their dependents at an agreed-upon rate. This rate is usually much lower than what they would charge if you were not a Costco employee or dependent. And they agree to accept the contract rate as full payment. You pay your coinsurance or copay along with your deductible.

Some plans do not offer any out-of-network benefits. For those plans, out-of-network care is covered only in an emergency. Otherwise, you are responsible for the full cost of any care you receive out of network.

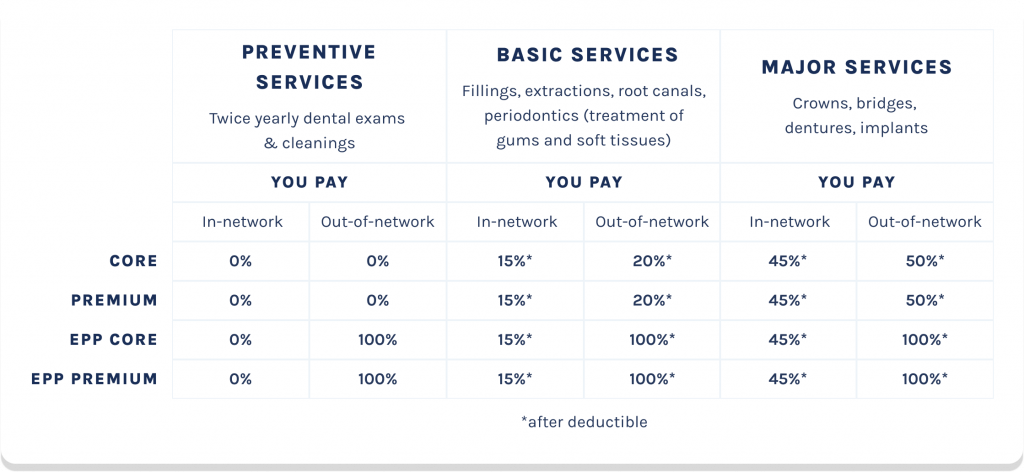

It pays to choose in-network dental care1

The Core and Premium (PPO) plans only pay up to Reasonable and Customary (R&C) charges for out-of-network dental expenses. The Core EPP and Premium EPP only pay for in-network charges. If you choose an out-of-network dentist, you’re responsible for all charges.

Why out of network dental care costs more

If you go out of network, your out-of-pocket costs are usually higher. There are many reasons you will pay more if you go outside the network, including:

The health plan pays less

Your Aetna health benefits or insurance plan may pay part of your dentist’s bill. But it pays less of the bill than it would if you got care from a network dentist. Also, some plans cover out-of-network care only in an emergency.

Out-of-network rates are higher

An out-of-network dentist sets the rate to charge you. It is usually higher than the amount your Aetna plan allows. Aetna does not base their payments on what the out-of-network dentist bills you. They do not know in advance what the doctor will charge.

An out-of-network dentist can bill you for anything over the amount that Aetna allows. This is called “balance billing.” A network dentist has agreed not to do that.

Cost sharing is more

The amount you pay an out-of-network dentist over the amount Aetna allows does not count toward your deductible. And it is not part of any cap your plan has on how much you must pay for covered services.

Many plans have a separate out-of-network deductible. This is higher than your network deductible (sometimes, you have no deductible at all for care in the network). You must meet the out-of-network deductible before your plan pays any out-of-network benefits.

With most plans, your coinsurance is also higher for out-of-network care. Coinsurance is the part of the covered service you pay after you reach your deductible (for example, the plan pays 80 percent of the covered amount and you pay 20 percent coinsurance).

You’ll have more work, too

Sometimes Aetna needs to approve some dental procedures before they are done. This is called precertification.

Some common procedures that require precertification include non-emergency surgery, dental implants and TMJ (temporomandibular joint) surgery.

If you visit a network dentist, that dentist will handle precertification for you. If you go out of network, you must take care of precertification yourself. That means more time and more paperwork for you.

You are covered for emergency care

You have this coverage whether you’re near your home or traveling. That includes students who are away at school.

When you need emergency care, go to any dentist. When you have no choice, Aetna will pay the bill as if you received care in network. You pay your plan’s copayments, coinsurance and deductibles for your network level of benefits.

They’ll review the information when your claim comes in. If they think the situation was not urgent, they might ask you for more information and may send you a form to fill out.

1Dental Access Plan — Procedure Price List powered by the Aetna Dental Access® Network. Each dentist has a different price list, but Aetna took averages from Los Angeles, New York, Chicago and Orlando.

Sources: Aetna. Network and out-of-network care.

Aetna. Procedures, programs and drugs that require precertification.

For more information about your Costco dental plan and how to find an in-network dentist, see the resources below.