3 MIN READ

APRIL 2025

Retirement planning: 3 ways Costco helps

Ever wonder what life will be like after you stop working? Often, what retirement will look like depends on how you prepare before you retire. Whether retirement is a year away or 25 years, learn what you need to know now for retirement later.

Looking for more? Find other articles below

Costco 401(k) Retirement Plan: The annual company contribution helps you grow your savings

Costco invests in your future with both matching and annual company contributions to your Costco 401(k) Retirement Plan account. Employees in Puerto Rico have the Costco Puerto Rico Retirement Plan.

Eligibility: Once an employee has completed a year of service, they’ll be entered into the company contribution portion of the plan beginning the first day of the month after their anniversary date.

Annual company contribution: Costco contributes a percentage of eligible earnings paid from the entry date – regular pay, overtime, vacation pay, holiday pay, sick pay, paid time off and extra checks – to your 401(k) account*, even if you don’t make any contributions of your own.

The contribution starts at 4% for an employee’s first few years, and increases as your years of service increase, capping at 9% after 25 years.

Matching company contribution: The company also matches 50% of your own contributions, up to $500 a year.

Best of all – these contributions belong to you with immediate 100% vesting.

To check your account balance, set up automatic payroll deductions, adjust your investment mix and much more, go to RPS.TRowePrice.com. You’ll also find financial tools and resources, including an Education Library, Retirement Income Planner and calculators:

- Paycheck Impact Calculator

- Contribution Maximizer

- College Planning Calculator

- Roth Comparison Calculator

- Social Security Calculator and more

2024 Annual company contribution: Costco contributed nearly $616 million to employee retirement accounts in 2025 for the 2024 annual company contribution. If you missed the letter Costco sent noting this year’s contribution amount, see your quarterly statement from T. Rowe Price.

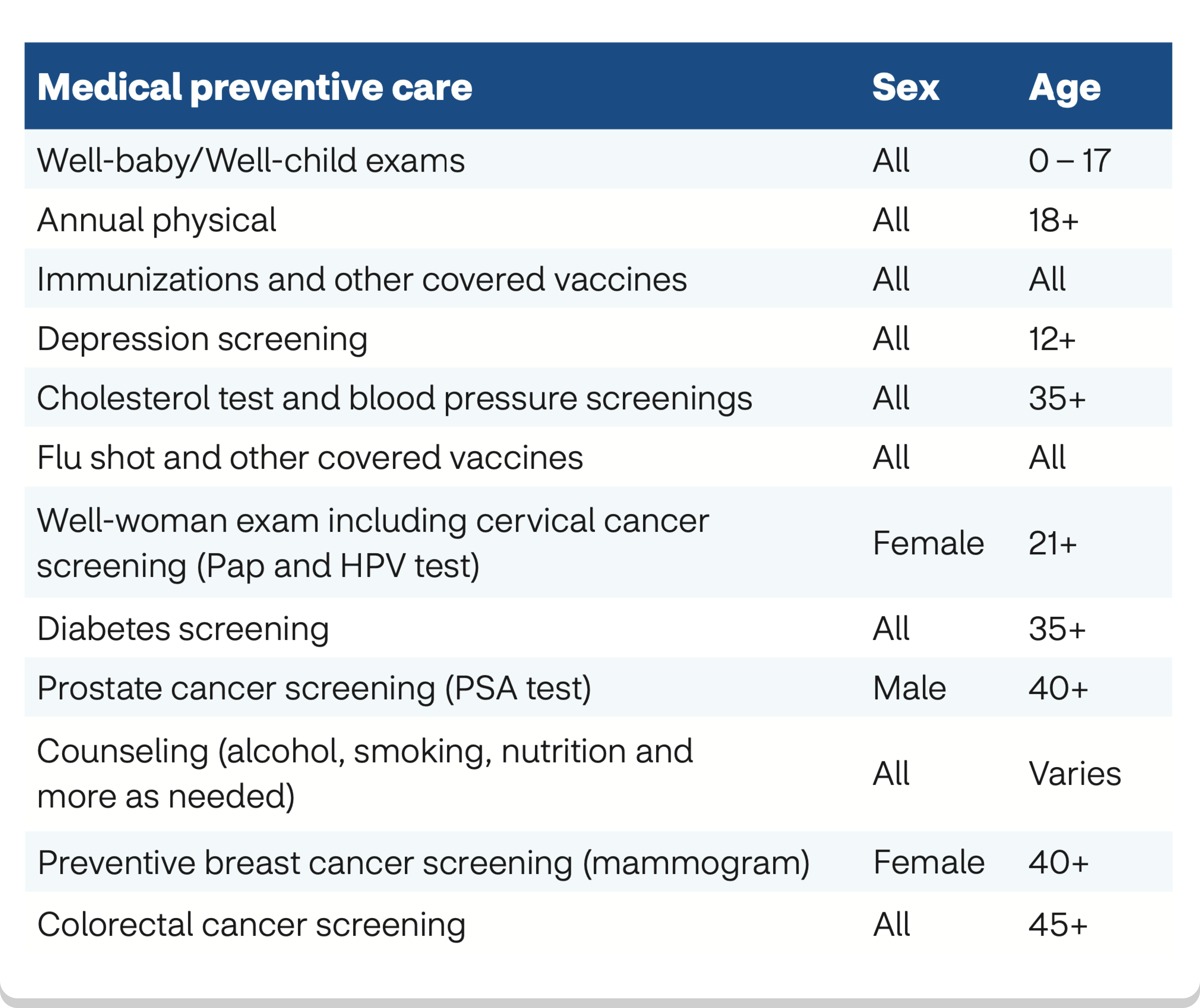

| Years of Service | Company Contribution | Average Contribution Per Year |

|---|---|---|

| 1-3 years | 4% | $1,371 |

| 4-9 years | 5% | $2,996 |

| 10-14 years | 6% | $4,198 |

| 15-19 years | 7% | $4,994 |

| 20-24 years | 8% | $5,897 |

| 25+ years | 9% | $7,147 |

*Employees at union warehouses should consult their collective bargaining agreement for more information about Costco’s contributions to their 401(k) plan.

Purchase company stock and become a shareholder in the company

The Employee Stock Purchase Plan (ESPP) with UBS lets you purchase Costco stock through payroll deductions. You choose the amount you’d like to invest each pay period. Fees and commissions for these purchases are fully paid by Costco. To learn more, visit Costcobenefits.com > Financial Wellbeing > Employee Stock Purchase Plan (ESPP).

Get familiar with Medicare — know your health coverage options before and after 65

While Medicare is available beginning at age 65, if you retire before age 65, you’ll need health coverage to fill the gap. You can explore coverage options available at HealthCare.gov, or you can contact the Benefits Department at 800-284-4882 to learn more about your retirement health plan options.

Do you or a family member have questions about Medicare, Medicare Advantage or Supplemental plans? Get answers to your questions. SGIA Medicare Consulting offers one-on-one support to help you find the plan that fits your needs. This service is available at no cost to all Costco employees and their families, including parents.

To connect with a Medicare expert, call 888-821-6486 or learn more at sgiamedicare.com/costco.