EXPLORE MORE

APRIL 2024

5 resources to help you navigate life

“In this world, nothing is certain but death and taxes.” – Benjamin Franklin

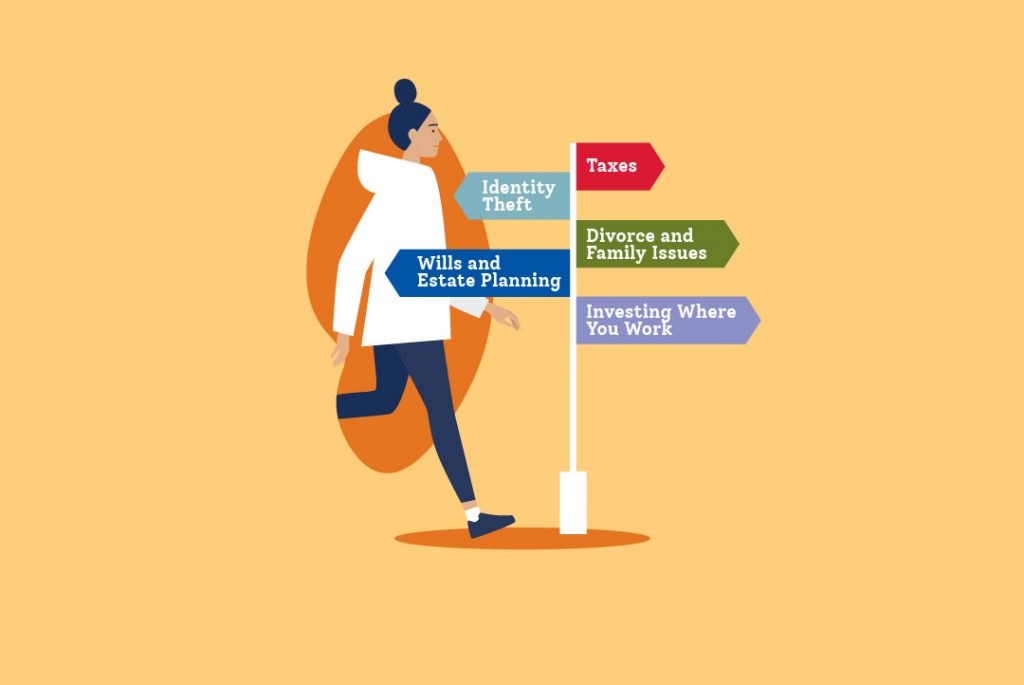

We’ve probably all heard this quote before. But did you know that your Costco benefits offer financial and legal services to help you with these two events — and many more in between? The following five topics may or may not apply to you, but if they do, make sure to use your benefits programs for support.

Looking for more? Find other articles below

Taxes

Let’s start with something that most Americans have to do — taxes. While it’s likely many of you have already filed your income tax return this year (the filing deadline is always April 15, unless that date falls on a weekend), there may be a few last-minute filers out there who can use a little help.

If you have any questions about your taxes, Resources for Living (RFL), your Employee Assistance Program, offers a free consultation with a tax professional, as well as articles on topics such as common tax errors and tax benefits for education. RFL’s tax team can also prepare your personal income tax return at a discounted rate.

Identity theft

Fraud and identity theft reports have nearly tripled in the last decade.1 And no one is immune. If you see any of the warning signs, such as bills for items you didn’t buy or debt collection calls for credit cards you didn’t open, the sooner you act, the better.

RFL’s identity theft and fraud resolution program provides free consultations with certified fraud specialists, 24/7. These specialists will work to restore your identity and credit history. You can also access RFL’s identity theft resource center for information and advice on how to protect yourself against identity theft before it happens.

Divorce and family issues

Going through a divorce can be a challenge. If you have property or assets to divide, or if you have kids and need to work out custody and child support arrangements, you’ll probably need legal assistance.

A free 30-minute consultation with an attorney through RFL is a good first step. Then, if necessary, use their online resource center to find an attorney or mediator in your area and get a discount on ongoing legal advice. You can also search the extensive legal library to answer your questions and educate yourself on the legal process.

Wills and estate planning

No one wants to plan for sickness or disability. But planning can make all the difference in an emergency and at the end of life. Being prepared and having important documents completed can give you peace of mind, help ensure your wishes are honored and ease the burden on your loved ones.

RFL offers free tools to create legal documents that outline how your estate and finances will be handled in the future, including a will, a living trust and a power of attorney. Access the RFL Legal Resource Center and register for an account to get started. These documents have detailed, step-by-step instructions and can be accessed at any time. You can also request a free 30-minute consultation with an attorney experienced in estate law to help get you started.

Investing where you work

As a Costco employee, you play a big role in the company’s success. Owning a stake in the company you work for means you can share in the profits you help build. This, in turn, may help grow your savings over time.

Through the Employee Stock Purchase Plan administered by UBS, you can purchase Costco’s common stock through regular payroll deductions. Costco covers the commissions, so there are no additional broker fees. Participation is completely voluntary and open to employees age 18 and older.

1 Federal Trade Commission. Consumer Sentinel Network data book 2022.

Sources:

USA.gov. Identity theft.

National Institute on Aging. Getting your affairs in order checklist: Documents to prepare for the future.

Use the following resources to help support your financial well-being.