EXPLORE MORE

AUGUST 2023

Money 101: Kids’ edition

You teach your children about safety, physical health, good study and work habits, acceptable behavior, and more. You want to instill in them all the things they’ll need to function well once they leave the family nest.

So why not include lessons on how to earn and manage money? After all, it makes sense for everyone to learn to spend wisely, save and invest what they earn.

Looking for more? Find other articles below

The best way to start teaching your children about money is to show them how you handle it. As soon as your children are old enough to understand, include them in your family’s budgeting, planning and saving discussions. As a bonus, your kids will know what to expect in terms of what the family can afford. They’ll also learn how their own choices can help them get things they want.

Be a role model for your children

Make sure your own financial behavior is responsible. If they see you spending money on things you don’t need instead of paying your bills, they may grow up thinking that’s an acceptable way to handle finances.

If you use credit cards, make sure your kids also see you checking your credit card statements and paying your bills on time. Show your children that those little plastic cards aren’t magical sources of free money. Let them see how much interest you pay, too.

Help them practice decision-making

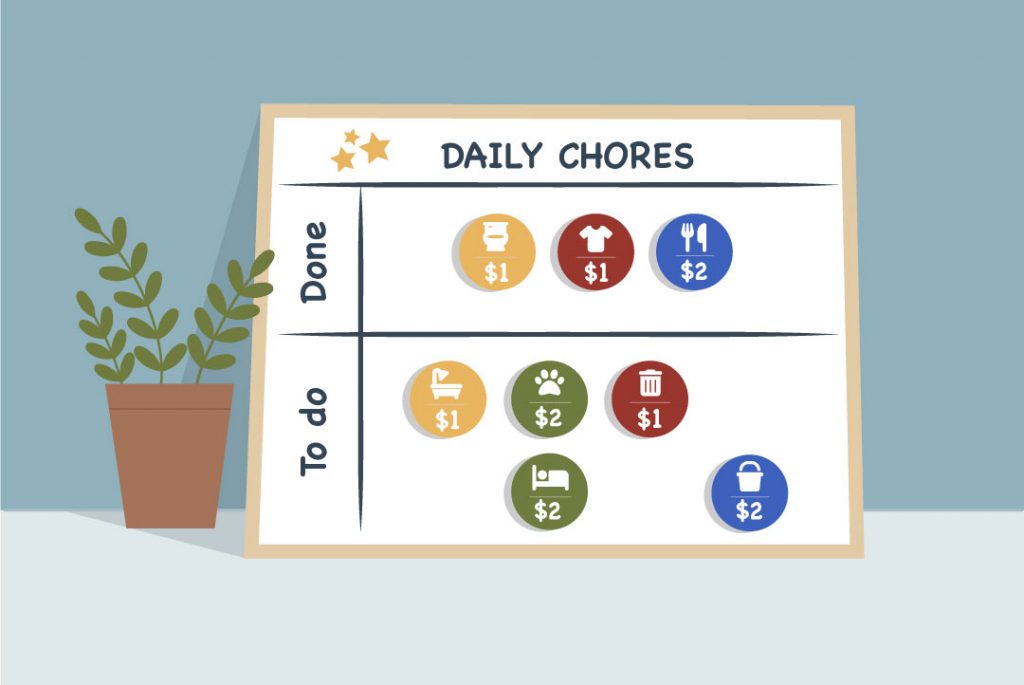

Let your children manage their own funds. When they get old enough, help them open and maintain a bank account. Whether they earn an allowance or income from a part-time job, help your kids make good decisions with their funds.

A lesson about saving on taxes

As every grown-up knows, taxes can be complicated. But it’s never too early to teach your children an important lesson: it pays to take advantage of the tax benefits you have.

For example, with a reimbursement account, administered by PayFlex®*, you can set aside pretax dollars and pay yourself back through a Health Care Reimbursement Account or a Dependent Care Assistance Plan.

The Health Care Reimbursement Account (HCRA) allows you to reimburse yourself for health care costs your medical plan doesn’t cover, such as out-of-pocket costs for medications and copays. The Dependent Care Assistance Plan (DCAP) lets you set aside pretax dollars to reimburse yourself for eligible child (under age 13) and elder care expenses necessary for you and your spouse to work, including child care and nursery/preschool costs.

Talk to your kids about how these accounts help your family save money on taxes. And remember to enroll in an HCRA or DCAP during Annual Enrollment.

*Available in Mainland and Hawaii.

Give your kids the tools to succeed

Encourage your children to save, and guide them in setting up a personal budget. Teach them how to compare prices before buying a pair of sunglasses, a skateboard or something else they want. Show them how much an investment account can grow over time by reviewing your retirement account’s growth together. That way, they can see the importance of saving even a small amount as soon as they start working as adults.

If they make a money mistake, don’t be too quick to bail them out. Instead, help them learn from it so they’ll make a better decision next time. As they get older, you can even show them more details about your family’s finances. For example, you can explain how interest can add up when you don’t pay off your credit cards each month or why making dinner is easier on your budget than ordering take-out.

Your kids can learn from all sorts of activities, including:

- Counting the coins in a piggy bank

- Creating a budget on paper or online

- Checking monthly statements for charges for apps and subscriptions

- Buying a used car and shopping for insurance

- Opening a savings account

- Researching how to finance their education

You can find teachable moments just about every day. It’s never too early to start setting your children up for financial success.

Source: Resources For Living. Teaching your kids about money.

Resources for you

- Resources For Living® (RFL®) provides you with access to a free 30-minute consultation for each of eight financial topics. Plus, you get free access to articles and tools on the RFL website. To learn more, call 833-721-2320 (TTY: 711) or visit RFL.

- SmartDollar® gives you a practical way to change how you handle money. Learn how to save more money, safeguard your family’s finances and make the best use of your Costco 401(k) Retirement Plan. You can also get one-on-one financial coaching — at no additional cost. Register and log in at SmartDollar, call 844-283-9381 or text COSTCO to 33789* to download the app.

- Want to enroll or re-enroll in an HCRA or a DCAP? Visit Costcobenefits.com and click “Health Care Reimbursement Account” or “Dependent Care Assistance Plan” under Financial Wellbeing to learn more. Then visit the Enrollment Website during Annual Enrollment, November 1-21, 2023, to make your annual elections.

- *Message and data rates may apply.

- Resources For Living® (RFL®) provides you with access to a free 30-minute consultation for each of eight financial topics. Plus, you get free access to articles and tools on the RFL website. To learn more, call 833-721-2320 (TTY: 711) or visit RFL.

- SmartDollar® gives you a practical way to change how you handle money. Learn how to save more money, safeguard your family’s finances and make the best use of your Costco Retirement Plan. You can also get one-on-one financial coaching — at no additional cost. Register and log in at SmartDollar, call 844-283-9381 or text COSTCO to 33789* to download the app.

- *Message and data rates may apply.

- Resources For Living® (RFL®) provides you with access to a free 30-minute consultation for each of eight financial topics. Plus, you get free access to articles and tools on the RFL website. To learn more, call 833-721-2320 (TTY: 711) or visit RFL.

- SmartDollar® gives you a practical way to change how you handle money. Learn how to save more money, safeguard your family’s finances and make the best use of your Costco 401(k) Retirement Plan. You can also get one-on-one financial coaching — at no additional cost. Register and log in at SmartDollar, call 844-283-9381 or text COSTCO to 33789* to download the app.

- Want to enroll or re-enroll in an HCRA or a DCAP? Visit Costcobenefits.com and click “Health Care Reimbursement Account” or “Dependent Care Assistance Plan” under Financial Wellbeing to learn more. Then visit the Enrollment Website during Annual Enrollment, November 1-21, 2023, to make your annual elections.

- *Message and data rates may apply.