TAKE ACTION

AUGUST 2023

Teach your child self-compassion by learning it yourself

Remember the first time your child said “mama” or “papa?” It was a thrilling moment for you. You helped by patiently repeating the word and pointing to yourself. Your child did their part by watching, listening intently and trying to mimic you.

In the first years of life, our children learn everything from language to how to catch a ball by watching and listening to us. As the years go by, they also learn from teachers, other kids, books, TV and social media. But when it comes to self-compassion, your child is taking almost all of their cues from you. Here’s how to help them take away the right lessons.

Looking for more? Find other articles below

What is self-compassion?

Whether it’s on the playground, at school, on the job or in our relationships, when we experience a setback, it’s common to respond in one of two ways. Either we become defensive and blame others, or we blame ourselves. Neither response is especially helpful.

Blaming others may lessen the sting of failure, but it comes at the expense of learning. Blaming ourselves, on the other hand, may feel deserved in the moment, but it can lead to an inaccurately gloomy view of our potential, which can undermine personal development.

What if instead we treated ourselves as we would a friend in a similar situation? More likely than not, we’d be kind, understanding and encouraging. Directing that type of response internally, toward ourselves, is known as self-compassion, and it’s been the focus of a good deal of research in recent years. Psychologists are discovering that self-compassion is useful in our personal growth and well-being.

Tips for teaching self-compassion

Children are masters of observation. They’ll pick up on — and repeat — both your words and your behavior. To that end, if you want your child to develop self-compassion, start modeling self-compassion, rather than self-criticism. Here’s how:

Acknowledge your feelings

It’s okay to not be okay! If you explain the context to your child — in an age-appropriate way — you show them how to discuss their feelings in a healthy way. Start by acknowledging they are experiencing an emotion. This simple act of acknowledgment, which may be as effortless as saying, “I can see that this upset you” can go a long way.

Give thanks

Positivity is a skill, and one way to build it up is through gratitude. Noting what you’re grateful for — even that first cup of coffee in the morning — nudges your brain to look for good things in other parts of your day. Sharing these observations aloud can teach your child to do the same.

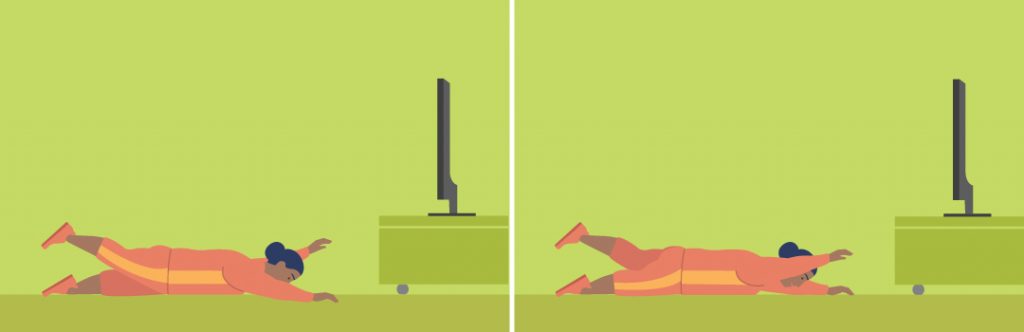

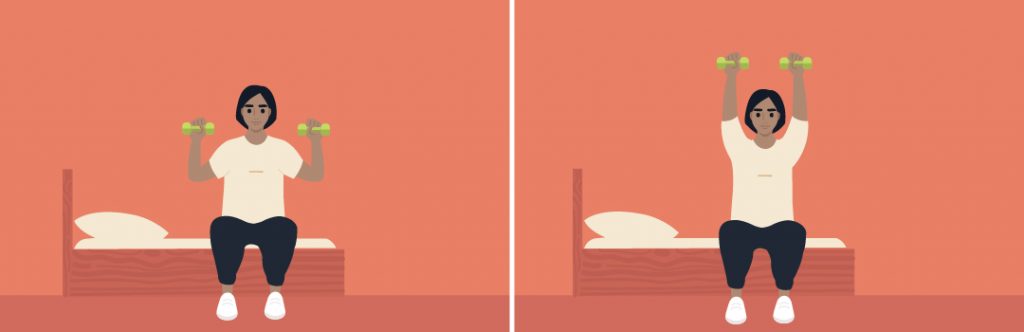

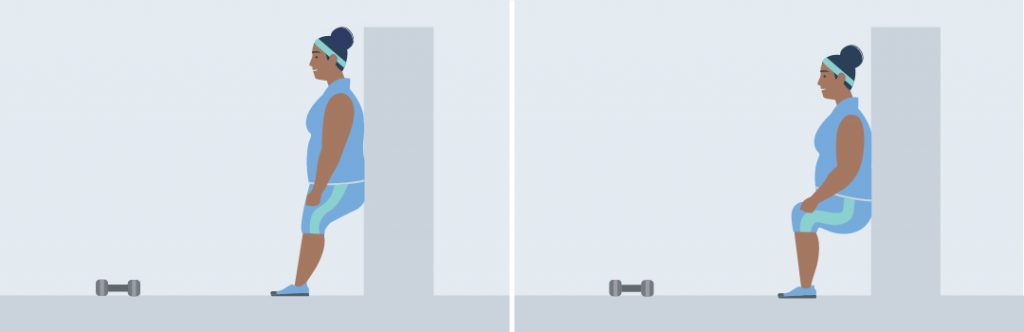

Practice self-care

Self-care shouldn’t be a reward you can only earn once you finish all your to-dos. If you try to bring it to the top of the list, your child will learn to care for themselves, too. Ask yourself: What makes you feel like the best version of yourself? Perhaps it’s taking a few minutes for yourself each day to read a book or spend time outdoors. Do your best to prioritize those things.

Forgive yourself

Self-compassion is key to self-acceptance, so show your child how it’s done! Focus on progress over perfection. When things go awry — as they always do — point out how you’re doing the best you can and moving forward, instead of dwelling on what didn’t go according to plan.

Learn something new

When you take time to try out new experiences and learn new skills, you’re teaching your child the value of curiosity and a love of learning — not to mention how to be resilient. (You won’t succeed at everything, and that’s okay!) Make a list of new things you’d like to try, then have at it.

Build emotional awareness

Emotions are often held in the body. That’s why you get butterflies when you’re excited or sweaty palms before a meeting. Becoming aware of when and how your emotions show up can help you better understand them. Share these insights with your child, and you can work on identifying emotions together.

Troubleshoot

No one expects you to be positive all the time. (And thank goodness, because that sounds exhausting.) If you’re having a bad day, use it as a teaching moment to share your feelings with your child. Your child can learn by watching you get through it.

And as helpful as techniques like deep breathing and meditation can be, sometimes you need to address the stressor itself. Once you pinpoint the source of your chronic stress, think about what’s within your control to change. A trusted friend or therapist can help.

Remember this takeaway

Changing your mindset may be a challenge. (It’s so much easier to be hard on yourself!) But when you try to be self-compassionate, your child is more likely to be kind to themselves, as well.

Source: The Greater Good Science Center. Three simple ways for kids to grow their self compassion.