EXPLORE MORE

OCTOBER 2023

Transform your smile — for less

Smile! Or would you rather not? With virtual visits, FaceTime, and selfie-friendly apps like Snapchat and Instagram, we’re all spending more time staring at our faces, and, in turn, our teeth. According to Dentistry Today, that behavior has intensified self-esteem issues regarding crooked teeth. And it’s driven more adults to seek orthodontic care.

Luckily, orthodontia is increasingly affordable. There are innovative orthodontic solutions to help you get the smile you want. And your Costco dental plans are here to help, with orthodontia benefits* for you and your covered family members.

Looking for more? Find other articles below

Braces or aligners?

Braces have been the traditional form of treatment used by orthodontists for decades. Today’s streamlined braces come in a variety of models — stainless steel, tooth-colored ceramic and those that attach behind the teeth.

Clear aligners are plastic replicas of your teeth. Wearing them puts gentle pressure on your teeth, ever so slightly repositioning them. Aligners are virtually invisible and can be removed when you eat, brush and floss. Invisalign® was the only clear aligner treatment available for years. But today, there are many options.

While braces are often better for kids and teens, especially if they have a severe crossbite, overbite or underbite, neither option is necessarily better than the other. The choice is based on your goals and your lifestyle. But some clear aligner options do present advantages, both in terms of their convenience and cost.

At-home treatment

These days, monthly appointments to adjust your braces aren’t a requirement to get a better smile. New online clear aligner services allow people to complete treatment in the comfort of their homes. These options work best for people with simpler corrections.

Some of these services supply you with materials to do at-home impressions of your bite. Once done, you send them in to be reviewed by a licensed dentist or orthodontist. Others work through a certified dentist who creates a 3D image of the inside of your mouth. After your impressions are reviewed, you’re sent a customized set of aligners that will gradually shift your teeth into place.

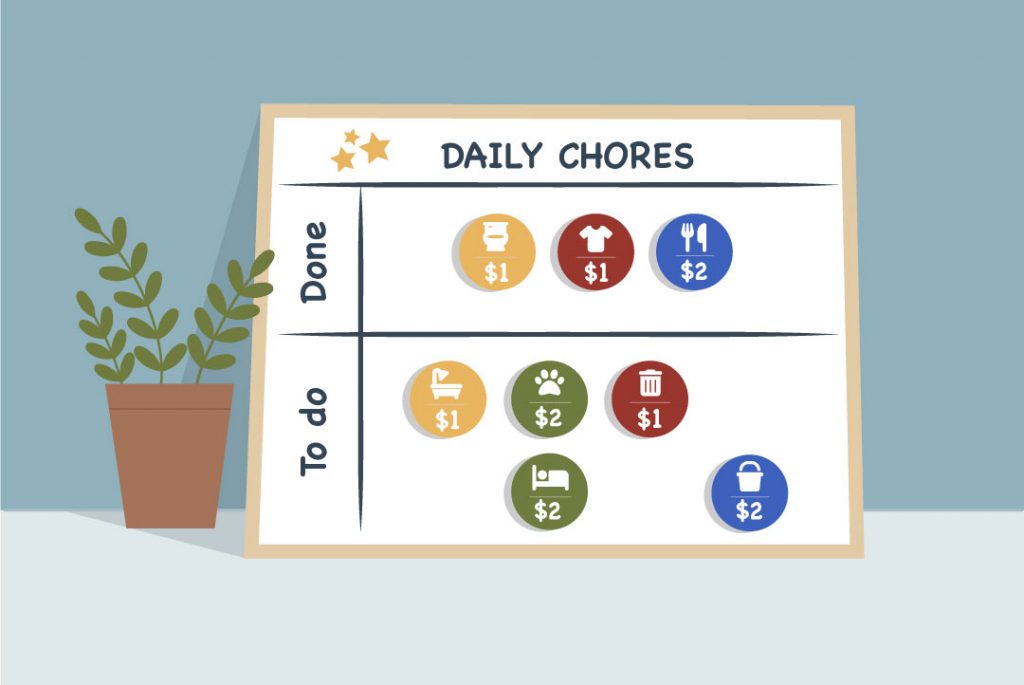

This do-it-yourself option is a huge advantage for many people, especially those living in the 60% of U.S. counties with limited access to an orthodontist’s offices. But there are other advantages, including:

- Cost. Traditional teeth-straitening solutions typically cost between $5,000–$9,000. These new orthodontic options, on average, cost between $2,000 and $3,000.

- Duration. Depending on complexity and your lifestyle choices, these treatments can last, on average, 4–5 months. Treatments using metal braces can take years.

- Support. Licensed dentists and orthodontists provide virtual support and oversight from beginning to end through dedicated, user-friendly apps.

- Convenience. Supplies are delivered directly to your home.

Contact your dental plan to find out which options are available to you.

Save more with an HCRA

Only available on the Mainland and in Hawaii

With your Costco benefits, you can open a Health Care Reimbursement Account, or HCRA. This account, administered by PayFlex®, allows you to set aside pre-tax dollars to reimburse yourself for expenses your plan doesn’t cover. You can use your HCRA to pay eligible orthodontic expenses for yourself and your covered dependents. You can also download the PayFlex Mobile® app to manage your expenses on the go.

Budget for your dental costs

Costco offers additional financial well-being tools for all locations, such as SmartDollar®, a free digital program that can help you plan for major dental expenses. This program also offers one-on-one financial coaching to talk you through the process.

*Review your plan documents for benefit details.

Sources:

Dentistry Today. 2022 trends to watch in oral & orthodontic care.

American Association of Orthodontists. Braces vs. clear aligners?

Your Costco dental plan and HCRA (where available) can make orthodontic treatment accessible for you and your covered family members. For resources to help, see below.