3 MIN READ

APRIl 2025

Your financial knowledge toolkit

Dealing with money and finances can be overwhelming. But small changes, wise choices, and a little guidance and support can help you reach your financial goals.

Looking for more? Find other articles below

Here are some tips:

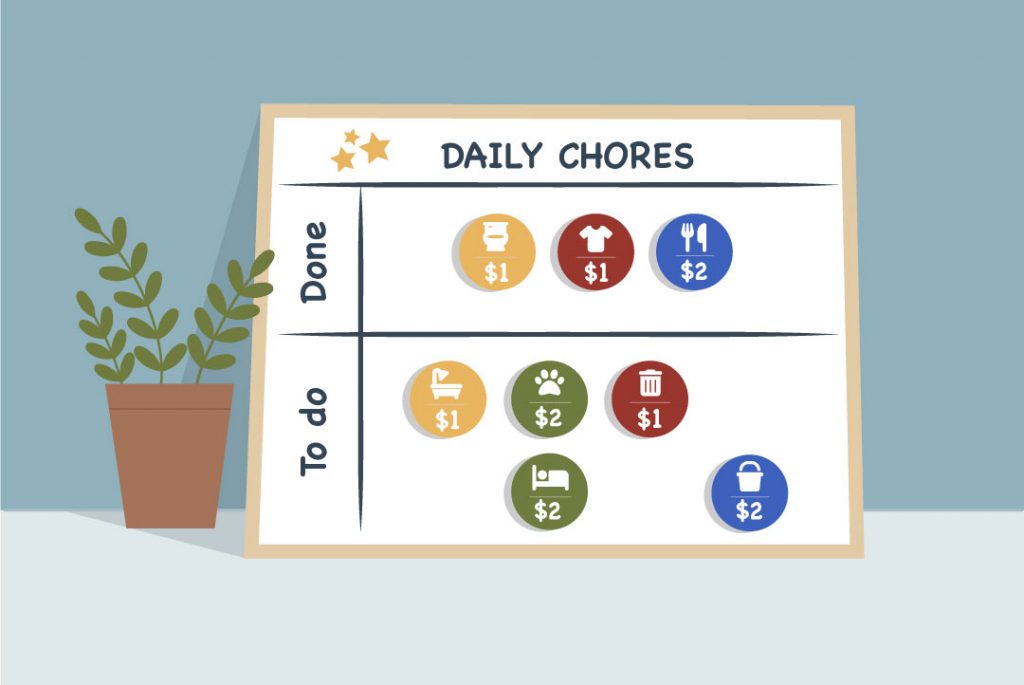

Be mindful with your spending

“I can’t afford a house, so I might as well treat myself to a fun weekend.” That might seem like a good idea in the moment. But here’s the truth: small, intentional spending decisions can add up more quickly than you think, and help you reach big goals.

Reduced spending can also reduce waste in landfills. Ordering out for dinner means higher meal costs plus plastic bags, boxes and other disposable materials. Meal planning for the week on a free day helps you save money and reduce your carbon footprint.

Write down your financial goals

What are your financial goals? What’s important to you? SmartDollar, your no-cost confidential online personal finance program, is designed to help you reach your goals.

SmartDollar’s step-by-step plan helps you take small steps to pay off debt and save more using the online budgeting tool. It keeps you motivated with video lessons from personal finance experts and gives tips to:

- Pay off debt faster

- Set up an emergency fund

- Save for college

- Buy a car

- Save for a down payment on a house

Free one-on-one financial coaching is also included. To sign up and get started, visit SmartDollar.com/enroll/costco or text Costco to 33789* to download the app.

If you want to grow your financial knowledge, additional financial resources are available through Resources for Living. Get a free 30-minute consultation per concern with a financial specialist. They can help with things like budgeting, credit repair and reports, mortgages and refinancing, debt management and tax questions. Visit RFL.com/Costco to request a free financial consultation.

Be smart about big purchases

Do your research before buying a house or car. Take the time to compare prices and learn about the market in your area. Consider things like rates and resale value to make an informed decision and get the best value for your money. Consider checking out the Costco Auto Program.

Watch these SmartDollar videos for additional ways to save:

Take advantage of these ways to save

Your Costco benefits can help you make the most of your money.

- Save on monthly expenses — New for 2025, you have access to LifeMart for employee discounts on gym memberships, virtual fitness and childcare.**

- Contribute to your 401(k) — Costco offers matching and annual contributions to your retirement plan with T. Rowe Price. To check your 40l(k) account balance, set up automatic payroll deductions, adjust your investment mix and much more, go to RPS.TRowePrice.com.

- Purchase company stock — The Employee Stock Purchase Plan (ESPP) lets you buy Costco stock through payroll deductions. You choose the amount you’d like to invest per pay period.

To learn more, visit Costcobenefits.com > Financial Wellbeing > Employee Stock Purchase Plan (ESPP). - Save on taxes — Use reimbursement accounts for eligible expenses.

- A Health Care Reimbursement Account (HCRA) lets you set aside pretax dollars to pay eligible medical expenses. You can use it for things like copays, deductibles and coinsurance, dental and vision expenses, plus prescriptions and over-the-counter items. Sign up for an HRCA during Annual Enrollment.

To learn more, visit Costcobenefits.com > Financial Wellbeing > Health Care Reimbursement Account. - A Dependent Care Assistance Plan (DCAP) lets you set aside pretax dollars to pay for qualified child and elder care expenses needed for you and your spouse to work. You can use it for expenses like day care, before- and after-school care, nursery and pre-school, and in-home aids. Keep in mind that the DCAP isn’t for dependent health care expenses. You can sign up, change or stop your DCAP based on your dependent care needs.

To learn more, visit Costcobenefits.com > Financial Wellbeing > Dependent Care Assistance Plan.

- A Health Care Reimbursement Account (HCRA) lets you set aside pretax dollars to pay eligible medical expenses. You can use it for things like copays, deductibles and coinsurance, dental and vision expenses, plus prescriptions and over-the-counter items. Sign up for an HRCA during Annual Enrollment.

NOTE: If you were enrolled in a reimbursement account in 2024, remember that your claim filing deadline is April 30. Any unused funds are forfeited after this date. Only your HCRA rollover amount of up to $640 can be carried over from 2024 to use in 2025.

*Message and data rates may apply.

**Childcare discounts are not available in Puerto Rico.