GET HELP

APRIL 2024

When your financial situation feels hopeless

In the classic Christmas movie It’s a Wonderful Life, George Bailey falls into despair after experiencing a financial catastrophe. He feels like his only way out is to take his own life. Sadly, this isn’t something that just happens in movies. People experiencing financial hardship are 20 times more likely to attempt suicide than those who don’t experience financial hardship.1

While Clarence, the angel who rescues George, is fictional, there is real-life help for people struggling with financial stress. Your Costco benefits are always there with free coaching, free counseling and in-the-moment mental health support to help you carve out a path to financial stability.

Looking for more? Find other articles below

Money worries are a common problem

In a recent Bankrate survey, 52% of adults said that money has a negative impact on their mental health at least occasionally. Among those impacted by money worries, almost one-third worry every single day.

A big part of those worries is debt. Life has become increasingly hard to afford, leading the average American to be over $52,000 in debt.2 Economic factors, student loans and increasing costs for housing, childcare, and even day-to-day expenses may set people up to spend more than they earn. These elements can combine to leave people fearing that they’ll never be able to pay off their debts.

Help is here

If you’re having financial challenges, you’re not alone in your struggle. There is help and hope. The best thing to do is take a two-tiered approach. Get help to address both the financial stressors and the impact these stressors have on your mental health.

Seek emotional health counseling

If you feel like you’re facing a financial crisis, working with a trained mental health clinician can help you learn ways to reduce those overwhelming thoughts. Resources For Living (RFL), your Employee Assistance Program, offers six free counseling sessions you can use to help with anxiety about your financial situation and discover coping strategies to regain hope and control.

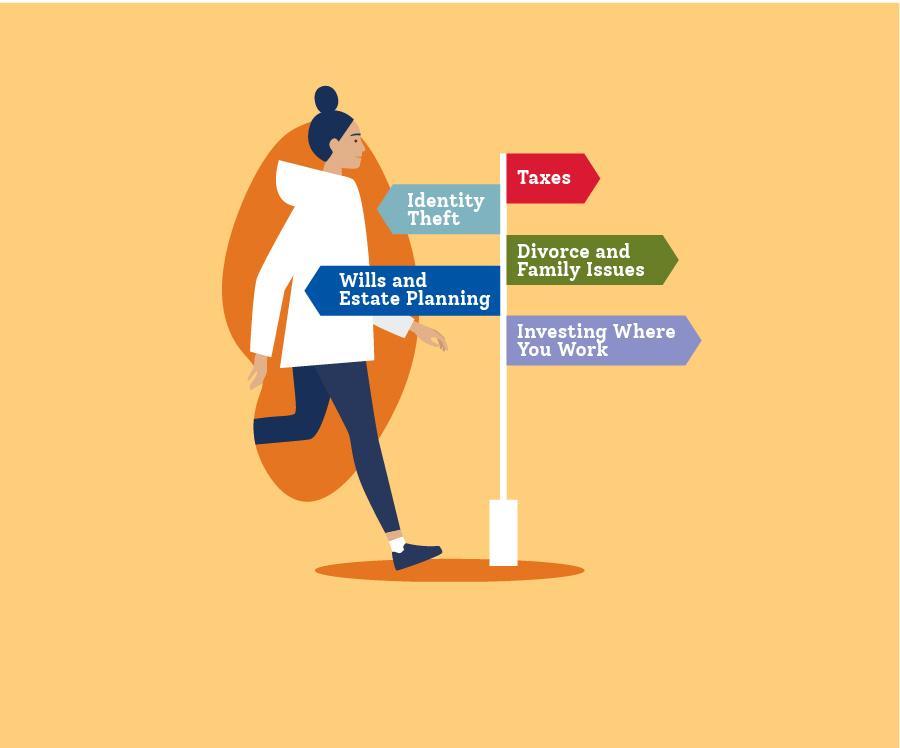

You can also take advantage of RFL’s free financial resources, including 30-minute consultations on topics such as:

- Credit and debt

- Financial planning

- Tax planning

- And more

Reaching out is not a sign of weakness and doesn’t mean you’ve failed as a provider, a parent or a spouse, or failed to live independently. Rather, it means that you’re able to recognize that your financial situation is putting you under stress and that you want to address it.

Seek financial coaching

A financial coach can help you strategize options or solutions going forward. Your coach will work with you to tackle your finances one step at a time. Together, you’ll create a personalized plan to improve your finances and relieve your stress.

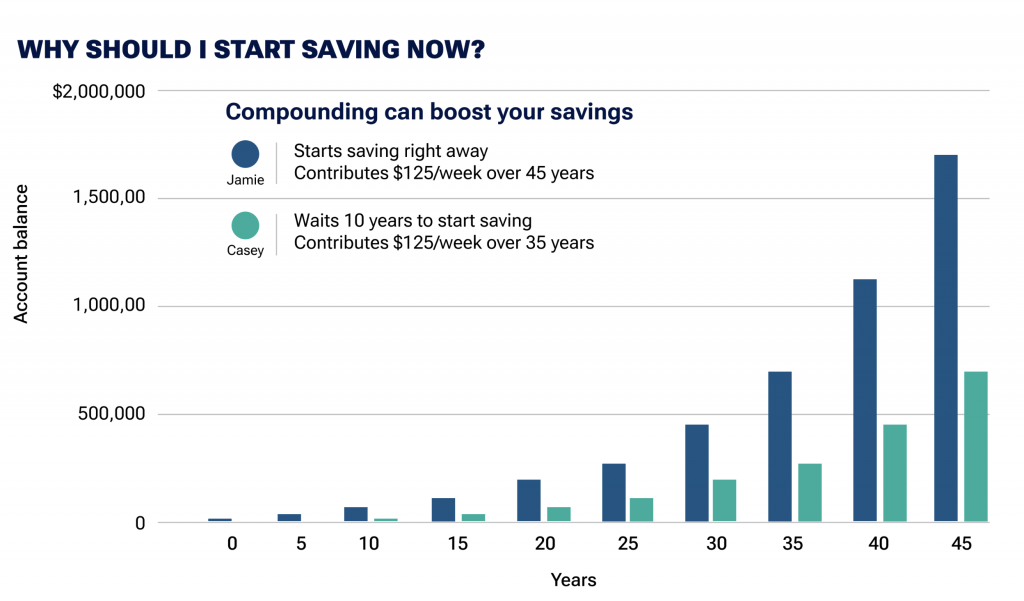

You can get free, one-on-one financial coaching with SmartDollar®. During your video calls, your coach can help guide you on how to:

- Pay off debt faster

- Create a personalized money plan

- Save for education expenses and retirement

- Get on the same page with your partner

- Feel more peace of mind

Schedule as many sessions as you’d like. And feel free to keep your camera off during your calls— your comfort and privacy matter.

A risk factor for suicide

While many people are very aware of the negative impact of financial stress, few know that financial hardship is a major risk factor for suicide. Stress over debt or difficulty in making ends meet can increase anxiety, distress and depression levels — all of which can put someone at risk for suicidal thoughts. Mental health conditions can also make it difficult to recover from financial stress. It’s a loop that can be hard to get out of.

If you or someone you know is having suicidal thoughts due to debt stress, money hardships, or any reason, seek emergency help. Call or text the Suicide & Crisis Lifeline at 988 or go to your nearest emergency department. Also call someone you trust – a friend, family member, coworker or clergy person.

1American Journal of Epidemiology. Financial strain and suicide attempts in a nationally representative sample of US adults.

2 Health.com. Financial stress is a leading catalyst for suicide — here’s how you can find help.

Sources:

Ramsey Solutions. Average American debt.

Bankrate. 7 ways to manage financial stress during trying times.

Forbes. The silent strain: How debt takes a toll on mental health

Getting yourself to a place of financial peace takes patience, persistence and a lot of support. The following resources can be essential in helping you get there.