TAKE ACTION

APRIL 2024

Savings dos and don’ts

Saving money not only feels good, it also gives you more control and opportunities throughout your life. With savings in the bank, you can more easily meet life goals, such as taking a big vacation, upgrading your home, or funding a child’s education.

And here’s the good news: Saving money is not as hard as it may seem. With some thought, planning and a little discipline, you can make small changes that can make a big difference.

Check out the ideas below for inspiration. And don’t forget to use your Costco benefits to help you reach your savings goals.

Looking for more? Find other articles below

Do automate your savings.

By setting up monthly automatic transfers from your checking account to your savings account, your money will build without any extra work on your part. Even if it’s just $25 a month, it will add up fast. Consider naming your savings account or accounts to match your savings dreams or goals, such as “vacation fund,” “emergency fund” or “down payment.”

Do take advantage of reimbursement accounts.*

Are your children in afterschool care? Do you need a dental crown replaced? Could your elderly parents use some in-home help? You can set aside pretax dollars for these expenses — and save money on taxes — with a reimbursement account administered by Inspira Financial (formerly PayFlex).

Enroll in a Health Care Reimbursement Account (HCRA) and/or a Dependent Care Assistance Plan (DCAP) during Annual Enrollment in November. You can also enroll in DCAP during the year if your childcare needs change.

Do teach your kids how money works.

Kids can and should develop good money habits at an early age. You can help by teaching them the connection between work and money and encouraging them to have short- and long-term savings goals. Younger children can watch their savings grow in a clear savings jar. Tweens and teens can be given more responsibility by using a banking app on their phone to follow their savings progress or make transfers from checking to savings.

Do start small.

It’s often easier to save if you start with a short-term goal. For example, committing to saving $20 a month for six months is more attainable than setting a goal to save $300 per month for a year. Once you reach your short-term goal, you’ll have created a habit of saving that can motivate you to keep going.

Don’t forget to monitor your autopay accounts.

Using autopay for gym memberships, streaming subscriptions and other services is a common practice. But this convenient way of paying also has its costs. In a recent survey, 42% of those polled continued to pay for subscriptions they no longer used.1 If you use autopay, make sure to regularly review what you’ve signed up for so you can cancel services you’re not using.

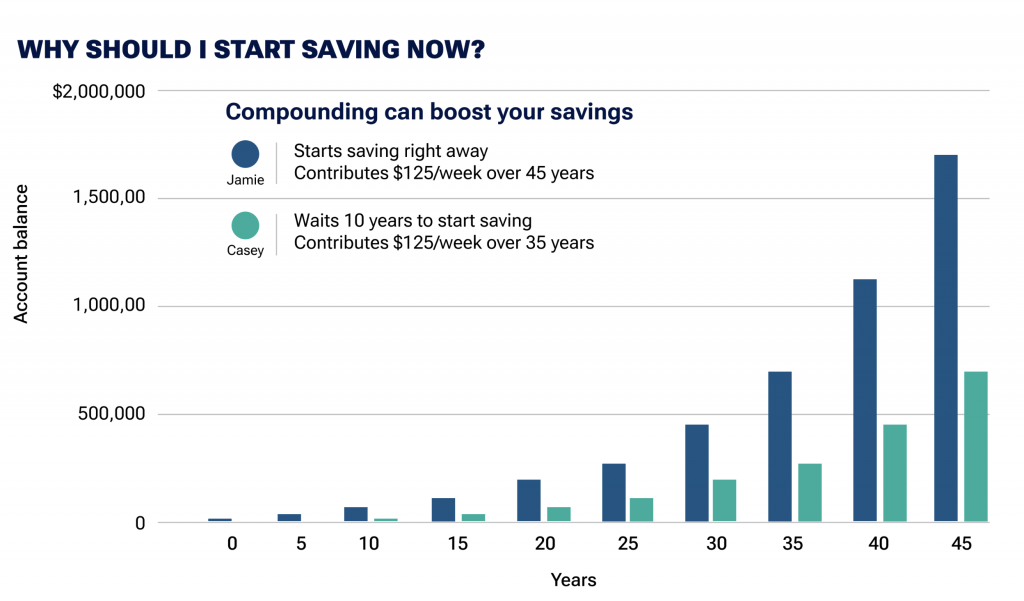

Don’t put off saving for your retirement.

Even saving a few dollars per paycheck for retirement can help you have a more secure financial future. The younger you start, the better, since you earn interest every year on both the money you save and the interest you earn along the way. For example, the chart below, provided by T. Rowe Price, shows the substantial impact that delaying your retirement contributions for ten years can have on the total amount you have available when you retire.

Costco’s retirement plan through T. Rowe Price makes it easy to save with automatic enrollment. You can choose a percentage of your pre-tax income to contribute. Costco makes contributions to your retirement plan even if you don’t contribute yourself.

Don’t skimp on preventive care.

Medical and dental conditions have better outcomes — and are less expensive to treat — when detected early. Make sure to get your annual physical exams, dental cleanings, vaccines and recommended screenings. Preventive care is free when you use an in-network provider.

Don’t go it alone.

We all have something to learn about improving how we manage our money. A SmartDollar® financial coach meets you where you are financially to help you make the changes necessary to reach your savings goals. You can start these free one-on-one sessions at any time and sign up for as many as you want. Spanish-speaking coaches are also available.

*Not available in Puerto Rico.

Sources:

NerdWallet. How to save money now (before you really need it).

Americasaves.org. 54 ways to save money.

Ramsey Solutions. What is a financial coach?

Ramsey Solutions. 15 ways to teach kids about money.