HEALTHY RECIPE

MAY 2024

Turkey pepperoni pizzas

The two ingredients for the pizza dough in this dish are plain fat-free Greek yogurt and white self-rising flour. If you can’t find self-rising flour, simply whisk 1 cup of regular all-purpose flour with ¼ teaspoon kosher salt and 1½ teaspoons baking powder.

This recipe calls for canned tomato sauce, shredded mozzarella cheese and turkey pepperoni, but feel free to experiment with whatever sauces, cheeses and meats you have on hand. Be sure to top your pizzas off with Parmesan cheese, fresh basil and a pinch of red pepper flakes for a touch of heat right before serving. These small finishing touches really elevate the final dish.

Ingredients:

1 cup plain fat-free Greek yogurt

1 cup self-rising flour

1 cup canned tomato sauce

¾ cup shredded part-skim mozzarella cheese

20 pieces small, thinly sliced turkey pepperoni

4 tablespoons grated Parmesan cheese

2 tablespoons basil, slivered

4 pinches (or to taste) crushed red pepper flakes

Directions:

Step 1

Preheat oven to 375 degrees F. Line a baking sheet with parchment paper.

Step 2

Put yogurt and flour in a large bowl. Stir well with a wooden spoon until just combined, then knead dough with your hands until smooth, about two minutes. If kneading is difficult because dough is too sticky, add more flour, 1 tablespoon at a time, until stickiness is gone.

Step 3

Place a large piece of parchment paper on a work surface and sprinkle with a little flour. Place dough on paper. Use a knife to cut dough into four equal pieces.

Step 4

Roll each piece of dough with a rolling pin to create a 6-7-inch oval. Place each oval on prepared baking sheet.

Step 5

Bake until dough is beginning to turn lightly golden, about 18 minutes.

Step 6

Remove from oven and top each oval with ¼ cup sauce, 3 tablespoons of mozzarella cheese and 5 pieces of pepperoni. Return to oven and bake a few more minutes, until dough is cooked through and cheese is melted.

Step 7

Serve each pizza sprinkled with 1 tablespoon parmesan, ½ tablespoon basil and a pinch of red pepper flakes.

Nutrition

1 pizza| Calories: 265 | Total fat: 7 g | Saturated fat: 4 g | Sodium: 1134 mg | Total carbohydrates: 30 g | Fiber: 2 g | Protein: 20 g

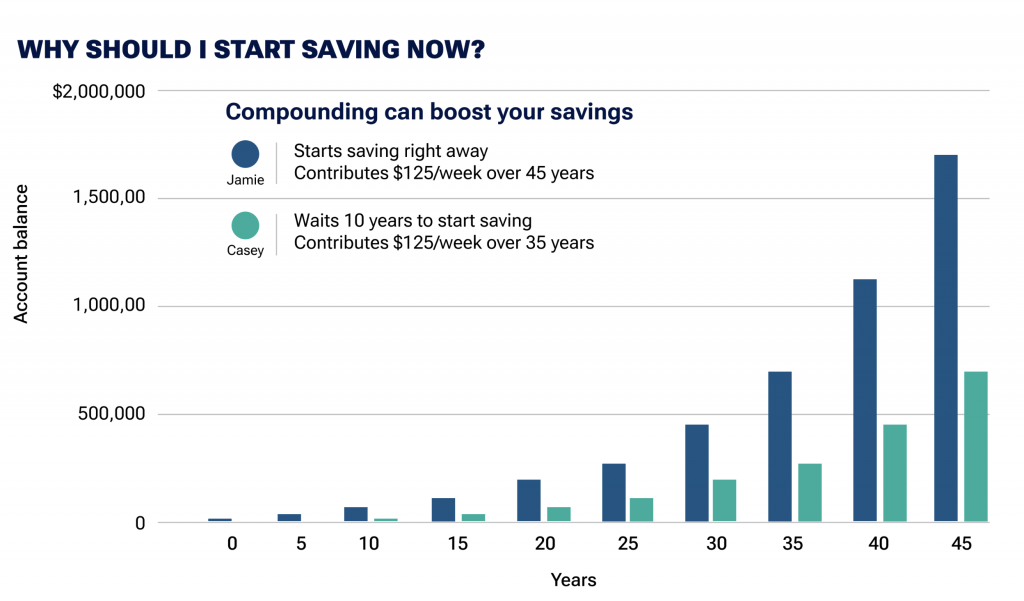

Source: WeightWatchers

With the WeightWatchers program and app, you can lose weight and eat healthier. Costco employees can join WeightWatchers for as low as $14 per month, and spouses/domestic partners and dependents can join for as low as $19.50 each per month. Participants must be age 18 or older to join. Sign up at WW.com/Costco or call 866-204-2885.